Do You Have To Register A Diesel In Arkansas

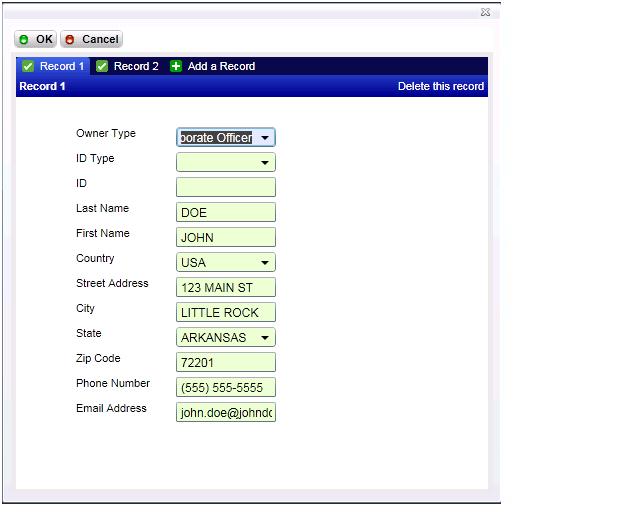

Owner, Officer, or Partner Information You are required to complete the Owner, Officer, or Partner section for each related business or individual. For individuals, select Owner SSN ID Type, enter the individual's Social Security Number, Last, and First Name. If an Owner, Officer, or Partner is another business or parent company, select Owner FEIN ID Type, enter the business's FEIN, enter the Business Name in the Last Name field, and leave the First Name blank. If your state is not available in the drop down, enter it in the "City" column. Example: "SOUTH MELBOURNE, VICTORIA". Enter all other information requested. Note: If an individual does not have an SSN, select Owner ITIN ID Type and enter the individual's ITIN.

You must click "Add a Record" to enter each subsequent Owner, Officer, or Partner.

Nature of Business Enter a brief description of the primary nature of your business activity. Example, "

Enter the 4-6 digit NAICS Code (2007 Version) that best describes the nature of your business. If you need help determining your appropriate NAICS Code please visit the For example, if you are a full service restaurant, you would enter 722110 in NAICS Code.

NAICS Code

Enter the trade name or doing-business-as (DBA) name of your business entity only if different from the Legal Name. You may have a different DBA name for each tax account you register if applicable.

Doing-Business-As (DBA) Name

Enter the primary physical location address of your business, including suite/apartment number. If you are a Sole Proprietor or Revocable Fiduciary/Trust; enter your home address. For other ownership types, this would be your main/headquarter location address. Your mailing address, where you would like correspondence from the State delivered, may be different from this address.

Owner Location Address

If your primary business mailing address, where you would like correspondence from the State delivered, is different from the location address, you will be prompted to enter that address. Otherwise, check the box "Check if same as Location Address".

Owner Mailing Address

You must enter the primary business contact type and name, phone number, and valid email address. This should be the person, business, or responsible party we will contact if additional information is required to process your registration application. You may optionally include your facsimile (fax) number.

Contact/Applicant Information

New Tax Account General Info

Enter the 4-6 digit NAICS Code (2007 Version) that best describes the nature of your business. If you need help determining your appropriate NAICS Code please visit the NAICS Website. For example, if you are a full service restaurant, you would enter 722110 in NAICS Code. Most businesses will have only one NAICS Code. However, you may enter a different code for each tax account you register if it is different from your overall business registration.

Nature of Business (NAICS)

Enter the trade name or doing-business-as (DBA) name of the business operating under this tax account only if different from the Legal or DBA Name of your overall business registration. You may have a different DBA name for each tax account you register if applicable. For example, the Legal Name may be

Doing-Business-As (DBA) Name

Indicate YES or NO if you would like to file your tax return online using ATAP. If YES, you will not receive pre-printed paper returns. If NO, pre-printed returns (when applicable) will be mailed to your address on record in advance of filing deadlines. ** By law, all Motor Fuel account holders are required to file and pay electronically.

Method of Filing Returns

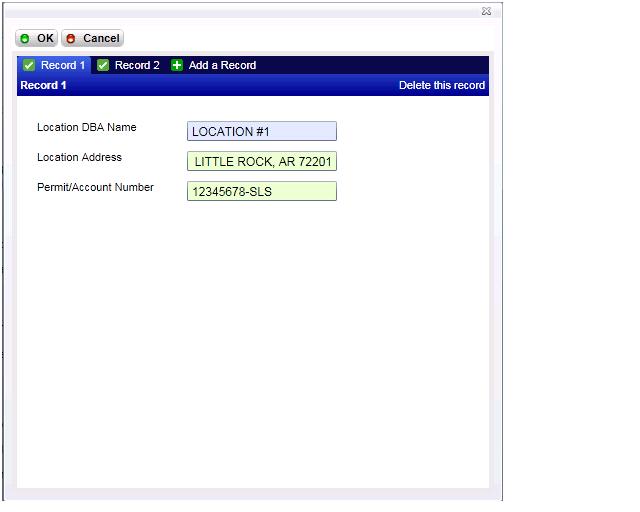

Enter the Location address of the business that applies to the tax type you are registering

Location Address

� � Sole proprietor required to list a home address for your main location that conducts sales or service from an office location.

� � Corporation who lists a home office as main location that conducts sales or service at a different location.

Enter the mailing address the State should send correspondence to regarding this tax account

Mailing Address

Enter the contact person and information the State can contact regarding this tax account

Contact Information

A signature is required on all applications for business with the Department. By clicking that you "Want to submit this request", the person listed under Contact/Applicant Information (or the account holder signed-in to ATAP for existing businesses) you declare under the penalties of perjury that the information provided (including any accompanying statements) has been examined by yourself, and to the best of your knowledge and belief is true, correct, and complete. Additionally, you state you have legal authorization to apply for business registration with the State of Arkansas.

Electronic Signature

Sales and Use Tax

Date You Will Begin Your Business Enter the date you will open or begin collecting sales tax or making taxable purchases for your business. If you do not know the actual date the business will open, estimate the opening date.

Purchase of Business, Inventory, Fixtures

� � Indicate YES or NO if you purchased the inventory, fixtures, or equipment of an established business. If YES, indicate the name and account ID of the former business and attach a copy of the Bill of Sale on the main page of this application.� If you do not have an electronic copy of the Bill of Sale please mail paper copies to:

* The former owner of a business must surrender the permit and report and pay all taxes due by the business through the transfer date. A lien will attach to the stock and fixtures to secure the State of Arkansas for delinquent taxes and is enforceable against the purchaser.

Combined Registration

PO Box 8123

Little Rock, AR 72203-8123

� � Enter the dollar value of the inventory you anticipate having when your business opens.

� � Enter the dollar value of the fixtures and equipment you anticipate having when your business opens.

If your business sells or serves alcoholic beverages, please indicate which type(s) and enter your Alcohol Beverage Control (ABC) permit number.

Alcohol and Private Club

� � Check whether the alcoholic beverages you sell or serve will be consumed ON or OFF your business premises.

� � Indicate if your business will operate as a Private Club.

� � If you have applied for your ABC permit but have not received the permit, please contact Combined Registration when you are approved by the ABC. Please visit the Department's Alcoholic Beverage Control site for additional information.

Indicate YES or NO if you operate more than one business in Arkansas.

Existing Businesses

� � If YES, you must list the name, address, and Arkansas Sales and Use Tax account ID for each additional business. You must click "Add a Record" to enter each additional business.

Leased Property and Home Business

� � Indicate YES or NO if you are leasing your business property. If YES, attach a copy of your lease agreement on the main page of this application.

� � Indicate YES or NO if you are operating a business from your private residence. If YES, attach a copy of your city business license on the main page of this application. If you do not have electronic copies of either your lease agreement or city business license please mail paper copies to:

Combined Registration

PO Box 8123

Little Rock, AR 72203-8123

Indicate YES or NO if you are operating a business that performs any type of service (including repair) within the State of Arkansas. If YES, please list and describe the service(s) performed in the state.

Out-of-State Business

A $50.00 non-refundable application fee is required of all Arkansas vendors on a retail or wholesale basis for each location registered with the State. Arkansas law requires each location collecting Sales or Use Tax to register and pay the $50.00 application fee. To register an additional location after your primary location is approved, please contact a customer service representative. Out of state vendors that lease property into Arkansas or perform taxable services in Arkansas are required to pay the $50 application fee. If applicable, you will be prompted to make the payment electronically at the completion of your registration. If the fee is required, a Sales and Use Tax permit will

Application Fee

Special Additional Taxes

Tourism Tax Tourism Tax should be collected, in addition to the state and local sales or use taxes, on the following:

� � The service of furnishing a condominium, townhouse, or rental house to a transient guest.

� � The service of furnishing a guest room, suite, or other accommodation by a hotel, motel, lodging house, tourist camp, tourist court, property management company or any other provider of accommodation to a transient guest.

� � A camping fee at a public or privately owned campground, except a federal campground.

� � The rental of a watercraft; boat motor and related boat equipment; life jacket or cushion; water skis; or oar or paddle by a boat dock, marina, canoe or raft rental business, or other business engaged in the rental of watercraft.

� � The admission price of the theme park, water park, water slides, river boat and lake boat cruises and excursions, local sightseeing and excursion tours, helicopter tours, excursion railroads, carriage rides, horse racing, dog racing, car racing, indoor and outdoor play or music shows, folks centers, observations towers, privately owned and operated museums, privately owned historic sites or buildings, and natural formations such as springs, bridges, rock formations, caves, and caverns. Tourist attraction does not include a special event; an even of school, college or university; or an event of a restaurant, coffee shop, dinner theater which admits dinner guests only, cafe, cafeteria, or any other public eating establishment that is open for business every month of the year.

Short Term Rental Tax should be collected in addition to the state and local sales or use taxes on the rental/lease tangible personal property, other than motor vehicles, for less than 30 days. For example: tools, equipment, etc.

Short Term Rental Tax

Short Term Rental Vehicle Tax and local rental vehicle tax should be collected in addition to state and local sales or use taxes on rentals/lease of motor vehicles for less than 30 days. This tax

Short Term Rental Vehicle Tax

� � Rentals of diesel trucks for commercial shipping

� � Semi-trailers, trailers, or other non-motor vehicles

� � Farm machinery or equipment leased for a commercial purpose

� � A gasoline-powered or diesel-powered truck leased or rented for residential moving or shipping

Long Term Rental Vehicle Tax should be collected, in addition to the state and local sales or use taxes, on the rental/lease of motor vehicles for 30 days or more.

Long Term Rental Vehicle Tax

Residential Moving Tax should be collected, in addition to the state and local sales or use taxes, on the rental/lease gasoline or diesel-powered trucks used for residential moving or shipping for less than 30 days.

Residential Moving Tax

There are 3 tax options applicable to businesses selling tangible personal property through a vending machine. Please contact the Miscellaneous Tax Section at 501-682-7187 for additional information concerning sales through vending machines and to obtain decals.

Wholesale Vending Tax

| Option | Sales Tax Permit Required? | Decal* | Tax Responsibility |

| 1 | No | No Fee | Tax paid to supplier on purchases |

| 2 | Yes | No Fee | Wholesale Vending Tax reported and paid on purchases |

| 3 | Yes | Fee | Decal Fee paid in lieu of tax |

* A decal is required for all vending machines regardless of the tax option utilized.

State aviation tax and local taxes are to be collected on the sales of aviation fuel. City and county taxes collected on sale of aviation fuel at publicly owned airports must be reported separately from all other sales. For a list of aviation fuel local codes, contact the Sales and Use Tax Local Tax Unit at 501-682-7105.

Aviation Fuel Sales

State tax collected on the sales of aircraft and aircraft related products must be reported as Aviation Tax.

Aviation Tax

Pay Fees

General Payment Information

� � Application Fee is the amount required with your application.

� � Payment Submission Date is the date you submit the application and fee payment. Funds will be withdrawn from your account via ACH Debit once the application review process has been completed. This may take several days.

� � You may set up an online payment method for your accounts once your application is approved.

� � Invalid account or routing numbers will delay your application and could cause you to incur a Non Sufficient Funds (NSF) penalty amount.

� � If you have questions or require assistance after you have submitted this transaction, Customer Support cannot view your banking information.

** Your banking account information will not be stored and will only be used for this single transaction.

Enter the 9-digit routing number for your financial institution. This can be found on your check. If you do not know the routing number please contact your financial institution for assistance.

Bank Routing Number

Enter the bank account number you wish for us to withdraw funds via ACH Debit. The account number must between 4-17 digits in length. You must re-enter the number for verification. This number can be found on your check. If you do not know your account number please contact your financial institution for assistance.

Bank Account Number

Select whether your account is a Checking or Savings account.

Type of Account

Select whether the account you are using for this payment originates from a source outside of the United States. Due to International ACH Transaction rules, Sales Tax application fees cannot currently be paid using funds originating outside of the United States. Please choose an account which will be funded inside the United States. **If you select YES to this question and submit the application, we will not record your account information or withdraw from this account. This will delay the approval process until payment is received.

Will the funds for this payment come from an account outside the United States?

Withholding Tax

Date Withholding Started or Required Enter the date that Arkansas Withholding started. This applies to Wage, Pension, and Pass-Through accounts. If you do not know the actual date, estimate the opening date. For additional information on Arkansas Withholding requirements or forms, visit the

Corporate Income Tax

Date You Will Begin Your Business Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

For additional information on Arkansas Corporate Income Tax requirements or forms, visit the Corporate Income Tax site.

Partnership Income Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Partnership Income Tax requirements or forms, visit the Partnership Income Tax site.

Motor Fuel Tax

Date You Began Purchasing or Importing Fuel Into Arkansas Enter the date you began or will begin purchasing or importing fuel into Arkansas. If you do not know the actual date, estimate the opening date.

For additional information on Arkansas Motor Fuel Tax requirements or forms, visit the Motor Fuel Tax site.

Indicate which types of fuel you plan to import/export or purchase for resale or distribution in Arkansas.

Sell or Distribute Fuel in Arkansas

Enter your DUNS number. If you do not have a DUNS number, you can visit www.dnb.com to apply for one.

Enter Your DUNS Number

Indicate YES or NO if you previously held a Motor Fuel Tax license in Arkansas. If yes, please enter your previous license number.

Have You Previously Held a Motor Fuel Tax License in Arkansas?

Indicate YES or NO if you transport petroleum in any device having a carrying capacity exceeding 9,500 gallons.

Do You Transport Petroleum in Any Device Having a Carrying Capacity Exceeding 9,500 Gallons?

Indicate YES or NO if you are acquiring an existing business that held a Motor Fuel Tax license. If yes, please enter the name of the company that you acquired and the account number.

Are You Acquiring an Existing Business that Held a Motor Fuel Tax License?

Indicate which method you will use if importing or exporting fuel into Arkansas.

If Importing or Exporting Fuel, How Will You Transport?

Indicate YES or NO if you have any bulk storage facilities in Arkansas. Bulk storage is defined as any container of 60 gallons or more.

Do You Have Bulk Storage Facilities in Arkansas?

Indicate the estimated number of gallons of fuel to be reported in the State of Arkansas each month for gasoline and diesel.

Indicate the estimated number of gallons of fuel to be reported in the State of Arkansas each month for gasoline and diesel.

Indicate which business activities may apply to your company if you are granted a license.

Business Activities

Dyed Diesel Tax

Enter the date you began or will begin purchasing or importing diesel fuel into Arkansas. If you do not know the actual date, estimate the opening date.

Distillate Supplier Start Date

For additional information on Arkansas Dyed Diesel Tax requirements or forms, visit the Motor Fuel Tax site.

Dyed Diesel accounts require an existing Motor Fuel Tax account be active. Indicate the account number or check the box if you have applied for a Motor Fuel account but have not received the account number.

Provide your Arkansas Motor Fuel Tax Account Number

Brine Severance Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Brine Severance Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Producer or Purchaser for Brine Severance Tax.

Classification

Natural Gas Severance

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Arkansas Natural Gas Severance Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are an Operator/Producer and/or a First Purchaser of Natural Gas.

Taxpayer Status

Natural Gas Severance accounts opened by producers require an Arkansas Oil and Gas Commission (AOGC) Producer Number. Enter that number here. If you do not have an AOGC number or need additional information, visit the

AR Oil/Gas Commission Producer Number

Oil Severance Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Oil Severance Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Producer or Purchaser for Oil Severance Tax.

Classification

Timber Severance Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Timber Severance Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Producer or Purchaser for Timber Severance Tax.

Classification

Other Severance Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Other Severance Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Producer or Purchaser for Other Severance Tax.

Classification

Beer Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Beer Tax requirements or forms, visit the Miscellaneous Tax site.

Enter your Alcohol Beverage Control (ABC) permit number. If you have applied for your ABC permit but have not received the permit, please contact Combined Registration when you are approved by the ABC.

ABC Permit Number

Please visit the Department's Alcoholic Beverage Control site for additional information.

Indicate if you are a Distributor only - instate or Native Brewery/Distributor - instate for Beer Tax.

Classification

Liquor Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Liquor Tax requirements or forms, visit the Miscellaneous Tax site.

Enter your Alcohol Beverage Control (ABC) permit number. If you have applied for your ABC permit but have not received the permit, please contact Combined Registration when you are approved by the ABC.

ABC Permit Number

Please visit the Department's Alcoholic Beverage Control site for additional information.

Indicate if you are a Manufacturer or Distributor/Wholesaler for Liquor Tax.

Classification

Wine Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Wine Tax requirements or forms, visit the Miscellaneous Tax site.

Enter your Alcohol Beverage Control (ABC) permit number. If you have applied for your ABC permit but have not received the permit, please contact Combined Registration when you are approved by the ABC.

ABC Permit Number

Please visit the Department's Alcoholic Beverage Control site for additional information.

Indicate if you are a Distributor or Small Farm Winery for Wine Tax.

Classification

Cigarette Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Cigarette Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Manufacturer or Wholesaler for Cigarette Tax.� If you are a Wholesaler indicate if you are a Resident Wholesaler or Non Resident Wholesaler for Cigarette Tax.

Classification

Indicate your Shipper Type and Shipper Account Information.

Shipping Information

Cigarette Papers Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Cigarette Papers Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Retailer or Wholesaler for Cigarette Papers Tax.

Classification

Other Tobacco Products Tax

Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

Date You Will Begin Your Business

For additional information on Other Tobacco Products Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Retailer, Wholesaler, or Manufacturer for Other Tobacco Products Tax.

Classification

Fantasy Sports Games Tax

Date You Will Begin Your Business Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

For additional information on Fantasy Sports Games Tax requirements or forms, visit the Miscellaneous Tax site.

Soft Drink Tax

Date You Will Begin Your Business Enter the date your business began or will begin. If you do not know the actual date, estimate the opening date.

For additional information on Soft Drink Tax requirements or forms, visit the Miscellaneous Tax site.

Indicate if you are a Retailer, Wholesaler, or Manufacturer for Soft Drink Tax.

Classification

Do You Have To Register A Diesel In Arkansas

Source: https://atap.arkansas.gov/webfiles/FAQ2.html

Posted by: marrowabeatice.blogspot.com

0 Response to "Do You Have To Register A Diesel In Arkansas"

Post a Comment